Key Takeaways

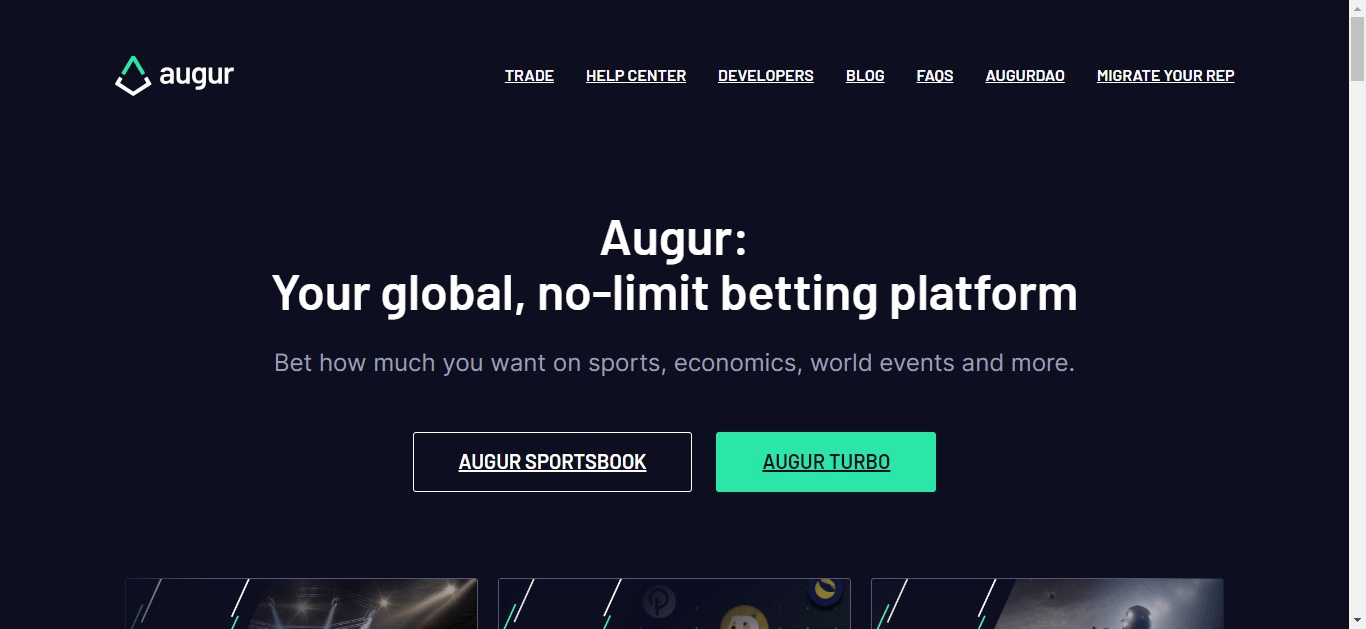

- Decentralized Oracle: Augur is a decentralized oracle and peer-to-peer protocol for prediction markets on the Ethereum blockchain.

- Components: It comprises two main components: Augur Pro and Augur Turbo, catering to different market needs.

- Immutable Protocol: The Augur protocol is immutable and free from governance, ensuring a fair and decentralized system.

- Associated Entities: The Forecast Foundation and PM Research Ltd are key entities associated with Augur, but they do not control or influence its use.

- Reputation Tokens: Augur uses Reputation (REP) and REPv2 tokens for staking and dispute resolution in the markets.

- User-Created Markets: Augur is not a prediction market itself; it is a protocol for users to create their own prediction markets.

- Variety of Market Types: The platform allows for a variety of market types, including binary options, derivatives, CFDs, futures, and options.

- Open-Source Software: Augur is open-source software, and users are free to fork and modify it, potentially leading to a diverse ecosystem of prediction markets.

- Trading and Liquidity Provision: Trading on Augur involves searching for markets, exploring market details, and managing portfolios. Users can also become liquidity providers.

- Claiming Winnings and Rewards: Augur allows users to claim their winnings and rewards directly from the platform.

- Potential Risks: Augur's decentralized nature can lead to unregulated and potentially risky markets.

Augur Review

Welcome to the world of Augur, a revolutionary decentralized oracle and peer-to-peer protocol for prediction markets. This article will guide you through the exciting landscape of Augur, illuminating its functionality, governance, and how it stands out from other platforms. We'll explore the world of Augur predictions, the platform's accuracy, and data sources, providing a comprehensive and enlightening Augur review.

2. Overview of Augur

Augur is a shining beacon in the world of blockchain, comprising two main components:

- Augur Pro: An Ethereum-based prediction market platform that empowers users to create their own markets.

- Augur Turbo: A layer two (Polygon) based prediction market featuring daily markets in sports, crypto, and other categories.

3. Understanding Augur Protocol

Let's demystify the Augur Protocol:

- Definition and Functionality: Augur is a protocol that elegantly solves the oracle problem, one of the most challenging issues in blockchain technology. It is a trustless decentralized peer-to-peer oracle employed on a predictive market protocol.

- Accessibility and Risk: The protocol is accessible to anyone and exists on the Ethereum public blockchain. However, users of the Augur protocol do so at their own risk.

- Immutability and Governance: The Augur protocol is immutable and free from governance. It lives and exists on the Ethereum public blockchain, and no single entity can modify, alter, update, upgrade, censor, or make any changes of any kind to the smart contract’s software.

4. The Role of The Forecast Foundation

The Forecast Foundation is a group of dedicated developers and technology professionals who are passionate about the potential of decentralized applications. While they support and develop the free, open-source protocol that is Augur, it's crucial to note that they do not own or lead Augur, nor do they receive any fees from the use of the protocol.

The mission of the Forecast Foundation is to advance transparent, open, and financially sound markets by supporting the development of open-source trading protocols, oracle systems, and related technologies. However, they have no role in the operation of markets created on Augur. They do not control how markets resolve or are created, nor do they approve or reject trades or other transactions on the network.

The Forecast Foundation does not have the ability to modify, cancel, undo, or interact with orders on the network. They have no power to censor, restrict, or curate markets, orders, trades, positions, or resolutions on the Augur protocol contracts. They do not provide investment or financial advice or consulting services to users.

The Forecast Foundation's role is limited to writing and publishing open-source software on Github. They do not host or operate any platform or version of Augur. If the Forecast Foundation were to disappear tomorrow, Augur could continue to function as it does today, underscoring the truly decentralized nature of the protocol.

5. PM Research Ltd

PM Research Ltd is a group of pioneering prediction market researchers. They are early adopters in the field of predictive forecasting, committed to advancing its adoption, research, and academic discoveries. Their work is not just theoretical; they actively operate educational and user resources to promote the practical application of predictive software.

Despite owning and operating the augur.net landing page and various social media accounts, PM Research Ltd makes no revenue from these web properties. Their primary goal is to foster understanding and use of predictive forecasting, rather than to generate profit.

It's important to note that PM Research Ltd operates independently of the Forecast Foundation, the group of core developers of Augur. They receive no funding from the Forecast Foundation for their services, further emphasizing their commitment to the unbiased promotion and development of predictive forecasting.

6. The Forecast Foundation & Augur Protocol Facts

Understanding the relationship between users, the Forecast Foundation, and the Augur Protocol is crucial:

- Direct Transactions: Users of the Augur Protocol don’t make transaction requests to the Forecast Foundation, they transact themselves, directly, peer to peer, with the virtual network, Ethereum.

- No Retained Information: The Forecast Foundation does not retain any information on Augur users, nor does it have the ability to.

- Non-custodial: The Ethereum blockchain and the Augur protocol is non-custodial. Augur protocol users can transact and perform actions on the Augur protocol using one or more different industry standard wallets of their choosing, such as MetaMask, Fortmatic, Torus and Portis.

- No Control Over User Assets: Because users retain full control of their private keys, the Forecast Foundation and the Augur protocol cannot spend virtual currency on a user’s behalf or against the user’s wishes. Nor can it freeze or forfeit virtual currency on behalf of law enforcement.

- Privacy: The Forecast Foundation and the Augur protocol does not know users’ wallet balances, legal names, mailing addresses, social security or national ID numbers, or any other identifying information.

- User Control: Users of the Augur protocol download the Augur software from Github, and bring their own Ethereum account to the protocol. Wallets and keys are decrypted in the users own browser, client side. Users send, receive, and perform actions on the Augur protocol with virtual currency using a wallet provider of their choice.

- No Special Access: The Forecast Foundation has no control over the markets created on Augur and has the same access to information as anyone else on the Ethereum blockchain.

Accessing and Using the Augur Protocol

To access and use the Augur protocol, follow these steps:

Required Tools:

Steps to configure Augur

8. Understanding Reputation (REP) and (REPV2)

In the Augur ecosystem, two key cryptocurrencies play a vital role: Reputation (REP) and REPv2. These tokens are not just currencies; they are integral to the functionality and governance of the Augur platform. They are used by reporters during the market dispute phases of Augur, and for staking on correct outcomes to receive a portion of the market's settlement fees. Let's delve deeper into their specific uses:

| Cryptocurrency | Use |

|---|---|

| Reputation (REP) | Used by reporters during market dispute phases of Augur. |

| REPv2 | Similar to REP, it is used for staking on correct outcomes to receive a portion of the market's settlement fees. |

9. Augur as a Prediction Market

Augur is a unique player in the world of prediction markets. Unlike traditional prediction markets, Augur is not a prediction market itself; it is a protocol for users to create their own prediction markets. This means that the users are the ones who create, operate, and participate in the markets, not the Augur platform itself. The platform merely provides the tools and framework for these markets to exist.

With Augur, anyone can create a prediction market about anything. From the outcome of a political election to the final score of a football game, the possibilities are endless. This democratization of prediction markets could have far-reaching implications, potentially revolutionizing industries like sports betting, financial derivatives, and even AI sports predictions.

10. Market Types on Augur Protocol

Augur Protocol supports a variety of market types, each with its unique characteristics and use cases. From binary options to futures, Augur offers a diverse range of possibilities for users to create and participate in prediction markets. Let's explore the different market types available on the Augur Protocol:

| Market Type | Description |

|---|---|

| Binary Options | Markets with two possible outcomes. |

| Derivatives | Markets derived from underlying assets. |

| CFDs | Contract for Difference markets. |

| Futures | Markets based on future predictions. |

| Options | Markets where participants have the option, but not obligation, to buy or sell. |

11. Role of the Forecast Foundation

The Forecast Foundation plays a pivotal role in the Augur ecosystem. It is responsible for writing and publishing open-source software on Github, contributing significantly to the development and maintenance of the Augur protocol. However, it's important to note that the Foundation does not operate an exchange, create markets, or process trades on the Augur protocol.

Instead, the Forecast Foundation's mission is to support the development of open-source trading protocols, oracle systems, and related technologies that advance transparent, open, and financially sound markets, as well as their underlying protocols and toolings. This commitment to transparency and decentralization is a key aspect of the Foundation's work and is integral to the operation and success of the Augur protocol.

Despite its significant contributions, the Forecast Foundation does not control or influence the Augur protocol. It is a non-profit organization that funds and builds the open-source software that powers Augur, the decentralized prediction market. However, the operation and governance of the Augur protocol are entirely decentralized, ensuring that no single entity, including the Forecast Foundation, can exert undue influence over the protocol.

12. Control, Influence, and Power over Markets

One of the defining features of the Augur protocol is its decentralized nature, which ensures that no single entity, including the Forecast Foundation, has control, influence, or power over the markets created on the platform. This decentralization is a double-edged sword, presenting both advantages and potential challenges for users of the Augur protocol. Let's delve into the pros and cons of this aspect:

Pros:

- The Forecast Foundation has no control, influence, or power over markets created on the Augur protocol, which ensures a fair and decentralized system.

Cons:

- This lack of control can lead to unregulated and potentially risky markets.

13. Market Delivery and Settlement

Settlement of markets on the Augur protocol is a seamless and transparent process, thanks to the power of blockchain technology. The markets are settled directly on the Ethereum blockchain through a set of smart contracts. This automated process ensures transparency and eliminates the need for any third-party involvement.

Augur markets follow a four-stage progression: creation, trading, reporting, and settlement. Once a market is created based on any real-world event, trading begins immediately. After the event on which the market is based occurs, the reporting and settlement stages commence. Users that hold Augur's native Reputation token stake their tokens on the actual observed outcome and, in return, receive settlement fees from the markets.

This decentralized and automated settlement process is one of the key features that sets Augur apart from traditional prediction markets. It ensures that the outcomes are fair, transparent, and free from manipulation, providing users with a reliable and trustworthy platform for prediction markets.

14. Augur vs Other Prediction Market Platforms

When it comes to prediction markets, Augur stands out due to its unique features and decentralized nature. It's a platform that has been designed with the user in mind, providing a level of control and freedom that is not typically found in other prediction market platforms. Let's take a closer look at how Augur compares to other platforms in the market:

| Aspect | Augur | Other Platforms |

|---|---|---|

| Control | Decentralized, no single entity has control. | Centralized, controlled by a single entity. |

| Market Creation | Users create their own markets. | Platform creates the markets. |

| Fees | Fees go directly to market creator and REP holders. | Fees usually go to the platform. |

As you can see, Augur offers a unique approach to prediction markets, emphasizing user control and direct participation. This decentralized model, coupled with the platform's robust reporting mechanisms and liquidity provision through automated market makers, makes Augur a promising choice for users interested in predictive forecasting.

Augur Alternatives

Play FairSpin Blockchain Casino For Secure and Transparent Crypto Gaming

Stake.com Review: Unveiling the Thrills of Crypto Gambling in 2023

BC Game: Premier Crypto Casino Experience with Bitcoin Slots and More

15. Fee Structure in Augur Protocol

The Augur protocol operates on a unique fee structure that is designed to be fair and transparent. Unlike traditional platforms, where fees are usually directed towards the platform itself, Augur's fees are distributed among market creators and REP holders. This structure not only incentivizes users to participate in the ecosystem but also ensures that the benefits are shared among those who contribute to the network's growth and security.

| Fee Type | Recipient |

|---|---|

| Market Creation | Market Creator |

| Reporting and Disputing Outcomes | REP Holders |

It's important to note that the Forecast Foundation, the group of developers behind Augur, does not receive any fees from the Augur protocol. This further emphasizes the decentralized nature of the platform and aligns with the foundation's mission of supporting the development of open-source trading protocols.

16. Forking and Modifying Augur

Augur stands as a testament to the power of open-source software. Users are not only free to use and participate in the Augur ecosystem, but they also have the liberty to fork and modify the software, respecting the open-source software licensing. This freedom fosters innovation and diversity within the prediction market landscape, as users can create their own unique versions of Augur.

17. Updates and Patches in Augur

Augur is a user-centric platform, and this philosophy extends to its update mechanism. Updates to the Augur Client are voluntary, meaning users have full control over whether to download and install any updates. The Forecast Foundation pushes updates through the main Augur repositories on Github. This approach ensures transparency and gives users the flexibility to choose when and how to update their software.

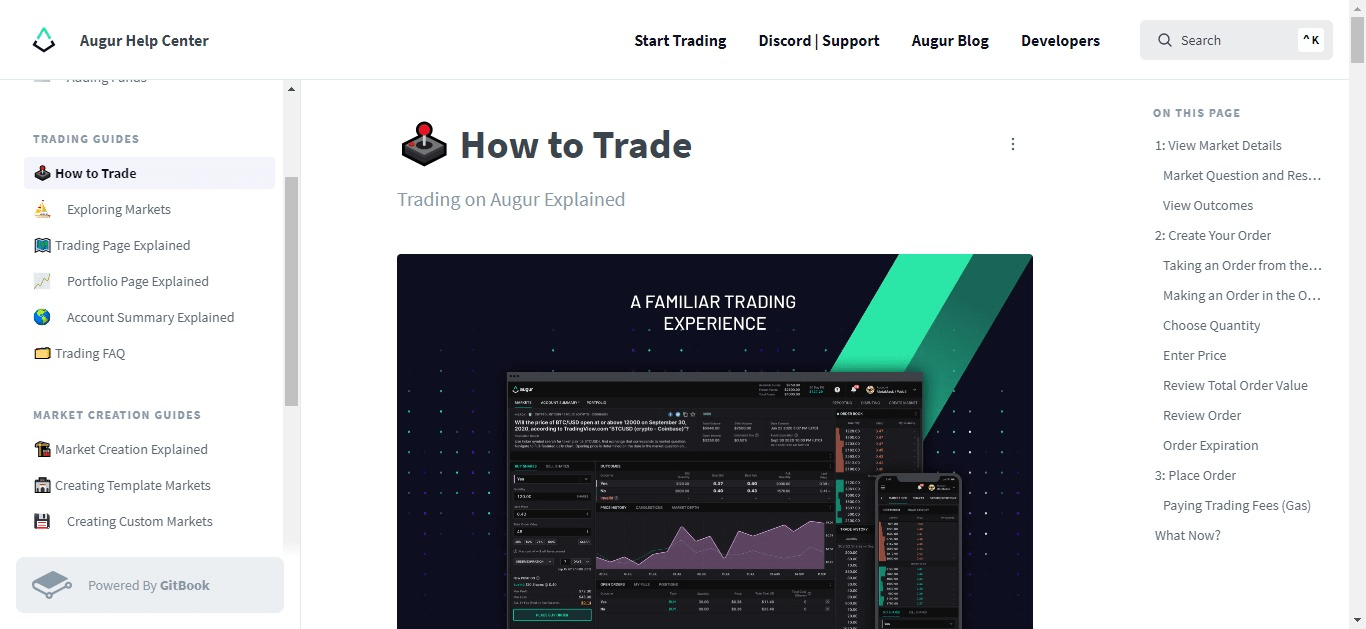

19. How to Trade on Augur

Trading on Augur is a seamless experience designed with user convenience in mind. Users can effortlessly search for the market they wish to trade using the search bar located in the upper right of the Market List page. By using a keyword, users can filter markets that include it in their title or description. For a more detailed guide on how to trade on Augur, you can visit here.

20. Exploring Markets on Augur

Augur's Market page is a treasure trove of information. Here, users can see the market question, event time, volume, liquidity, the date the market expires, and the market creator’s address. This comprehensive information allows users to make informed decisions when participating in markets. For a more detailed guide on exploring markets on Augur, you can visit here.

21. Understanding the Market Page on Augur

The Market page on Augur is a comprehensive dashboard that provides users with all the details about a market. It includes:

- The market question

- Event expiration

- Volume: The sum of all shares that have changed hands for a particular market. Both total volume for the market and 24-hour volume are displayed.

- Liquidity: The amount of funds added to the market's pool. If there's no liquidity, then you won't be able to buy shares. Low liquidity may result in a higher level of slippage.

- Estimated Fees (shares): Fees are paid in shares. This is an estimate of how much will go to the market creator and liquidity providers.

- The market creator’s address

For a more detailed guide on the Market page on Augur, you can visit here.

22. Understanding the Portfolio Page on Augur

The Portfolio page on Augur is a user's personal dashboard, where they can quickly see:

- Their account balance

- Current positions

- Winnings they have to claim

- Their transactions

- Any liquidity they may have provided

For a more detailed guide on the Portfolio page on Augur, you can visit here.

23. Claiming Winnings on Augur

Claiming your winnings on Augur is a straightforward process. Here are the steps:

- Go to the top of the page and click on the "Claim Winnings" button. This action will claim winnings for all markets.

- If you prefer to claim from each market individually, navigate to the markets under your positions tab.

- Select the market from which you want to claim your winnings.

- Click on the "Claim Winnings" button for that specific market.

Note: The settlement fee in orange is what is paid to the market creator.

For a more detailed guide on claiming winnings on Augur, you can visit here.

24. Becoming a Liquidity Provider on Augur

Augur allows users to become liquidity providers, a role that involves adding to an existing pool and receiving a mix of outcome shares and Liquidity Provider (LP) Tokens. This process involves the following steps:

- Go to the settings button at the top right of the page (or the slide out menu on mobile devices) and toggle the "Show liquid markets only" button to off.

- Enter the amount of liquidity you wish to provide to the market.

- Set the prices (odds) for each outcome. These prices need to be between $0.02 and $1.00, and the total of all outcome prices must add up to $1.

These positions will show up in your portfolio. For a more detailed guide on becoming a liquidity provider on Augur, you can visit here.

25. Tracking Your Liquidity on Augur

Users can track their liquidity on Augur. The shares added to the liquidity pool are managed in such a way that the individual prices of each share in the pool stay constant. This means that higher priced outcomes must have fewer shares added, leaving you with a position in that outcome. For a more detailed guide on tracking liquidity on Augur, you can visit here.

26. Removing Liquidity on Augur

As a user, you have the option to remove your liquidity from Augur. This process may return shares, which can be sold for USDC if there is still liquidity in the pool. Winning shares can be redeemed for USDC after the market has finalized. Here are the steps to remove liquidity:

- Navigate to the liquidity page on Augur.

- Click on the 'Remove' button.

- Confirm the amount of liquidity you wish to remove.

- Approve the transaction.

For more detailed instructions, please refer to the official guide.

27. Claiming LP Rewards on Augur

Third parties may provide LP rewards using Augur smart contracts. To claim these rewards, users must remove their liquidity before funds are depleted. If the rewards contract is depleted, users can still remove their liquidity to return their remaining LP available balance, but estimated rewards earned will not be included. Here's how to claim LP rewards:

- Go to the rewards page on Augur.

- Click on the 'Claim Rewards' button.

- Confirm the transaction.

For more information, check out the official guide.

28. Migrating to REPV2

Users can migrate to REPV2 by following these steps:

- Navigate to the migration page on Augur.

- Click on the 'Migrate' button.

- Once processed, you should see a 'Migration Successful' confirmation message.

After successful migration, you'll see your REPv2 Balance! For more details on migrating to REPV2, refer to the official guide.

29. Conclusion

Augur stands as a beacon of innovation in the world of predictive forecasting. As a decentralized prediction market protocol, it offers a fresh perspective on predictive analytics. Its open-source nature and focus on user control provide a platform where anyone can create their own prediction markets, fostering a diverse ecosystem of predictive analytics.

However, this decentralization also presents challenges. The absence of a controlling entity can lead to unregulated and potentially risky markets. Users must navigate these waters with caution and diligence.

Despite these challenges, the potential of Augur is undeniable. It represents a significant step forward in the integration of blockchain technology into the world of predictive markets. For those interested in the cutting-edge intersection of blockchain, predictive analytics, and AI betting, Augur presents an exciting opportunity.

For more information, follow Augur on their official website, Twitter, Reddit, and Facebook.

Pros:

- Augur is a unique, decentralized prediction market protocol that offers a new approach to predictive forecasting.

- With its open-source nature and user-centric control, it provides a platform for anyone to create their own prediction markets.

Cons:

- The lack of control by any single entity can lead to unregulated and potentially risky markets.

Frequently Asked Questions

What is Augur?

What are the main components of Augur?

What is the role of the Forecast Foundation in Augur?

How does Augur solve the oracle problem?

How can I trade on Augur?

- Daniel